Selling TOL puts for income.

The residential real estate market continues to be strong, and TOL is a natural beneficiary. The homebuilder specializes in high-end luxury homes which are in high demand. Inflation should also help the company realize higher selling prices while boosting the value of land held.

Shares broke to a new high while the rest of the market was under pressure. Meanwhile, the stock trades for less than 8 times next year’s expected earnings — an attractive value in today’s expensive market.

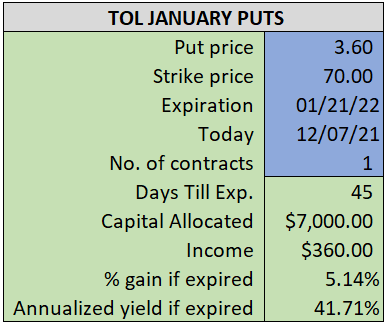

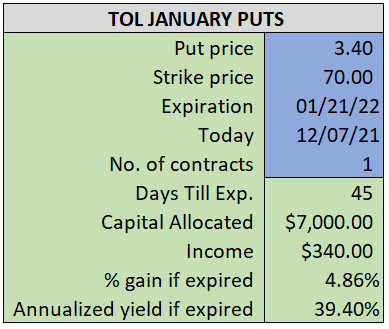

By selling the January $70 puts near $3.40, we’re able to collect income that gives us more than 39% in annualized profits, while also giving us a small cushion between the current market price for TOL and our strike price.

- Sell (to open) 1 TOL January 21st $70 put

- Limit: $3.40 or more

- The new position will represent roughly 7.2% of our model.

~~~~~~~~~ - 11:30 Executed

- Sold 1 TOL Jan 21st $70 put @ $3.45