Selling NCLH puts for income.

Cruise Lines like Norwegian Cruise have been pushed lower once again due to fears of the Omicron coronavirus variant.

But taking a step back, it appears this variant may not be as dangerous as originally expected and between vaccines and therapeutics, the coronavirus crisis is finally starting to become less of a concern.

Shares should rally as investors realize the risk is muted. And profits should rise as more vacationers book trips for 2022.

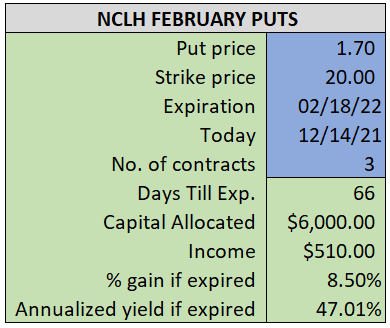

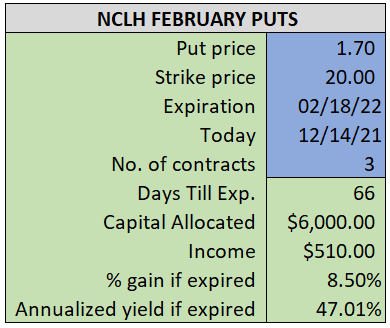

By selling the February $20 puts near $1.75, we’re able to collect an annualized yield above 47% while also giving us roughly $0.70 per share in cushion between the current market price for NCLH and our strike price.

- Sell (to open) 3 NCLH February 18th $20 puts

- Limit: $1.70 or more

- The new position will represent roughly 6.4%% of our model.

~~~~~~~~~~~ - 10:11 Executed

- Sold 3 NCLH Feb 18th $20 Puts @ $1.73