Selling MT puts for income.

Arcelor Mittal (MT) is a global steel manufacturer benefiting from the overall global reopening trend. Manufacturing continues to improve thanks to strong demand for vehicles, appliances and many other products.

MT is expected to earn nearly $7.00 per share next year and yet the stock currently trades round $32.70. That’s a deep value and should provide a bit of a floor below the stock price and protect against a pullback.

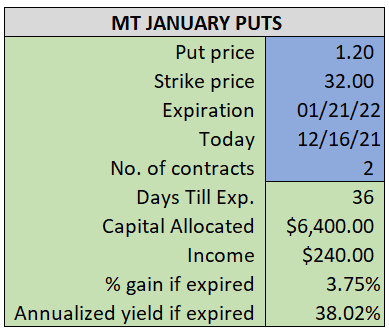

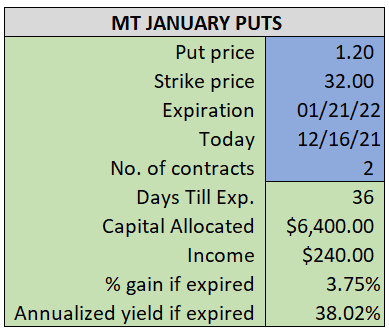

By selling the January $32 puts near $1.20, we’re able to collect an annualized yield near 38% while also giving us roughly $0.75 per share in cushion between the current market price for MT and our strike price.

- Sell (to open) 2 MT January 21st $32 puts

- Limit: $1.20 or more

- The new position will represent roughly 6.9%% of our model.

~~~~~~~~ - 10:41 Executed

- Sold 2 MT Jan 21st $32 puts @ $1.25