Selling TRIP puts for income.

TripAdvisor (TRIP) shares have moved steadily lower due to travel concerns. But recent data shows that individuals are now more likely to book trips. Meanwhile, Omicron is turning out to be less severe than some had feared.

Shares of TRIP have begun to rebound as concerns fade. The chart is forming a double bottom which is positive for technical traders. And our put-selling strategy allows us to collect income while still using our Triple Play Defense strategy to protect your capital.

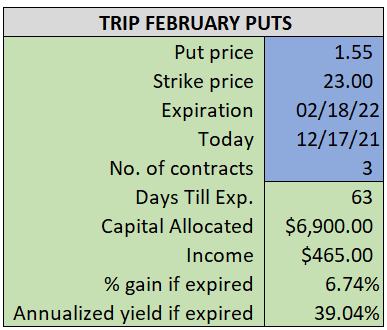

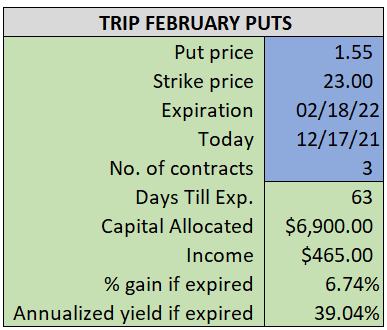

By selling the February $23 puts near $1.55, we’re able to collect an annualized yield near 39% while also giving us roughly $1.75 per share in cushion between the current market price for TRIP and our strike price.

- Sell (to open) 3 TRIP February 18th $23 puts

- Limit: $1.55 or more

- The new position will represent roughly 7.5% of our model.

~~~~~~~~~ - 10:46 Executed

- Sold 3 TRIP Feb 18th $23 Puts @ $1.61