Selling HZO puts for income.

Marinemax Inc. (HZO) sells high-end recreational boats along with parts, servicing and ancillary products.

The company built a strong business during the crisis period and now has a large installed base of customers who will need servicing on their new boats along with merchandise to enjoy the upcoming season. (Think of HZO like a YETI for water enthusiasts).

The stock has been steadily rising and is still very cheap compared to earnings. With plenty of premium in the put contracts, HZO gives us a great opportunity to use market volatility to lock in a lucrative income payment.

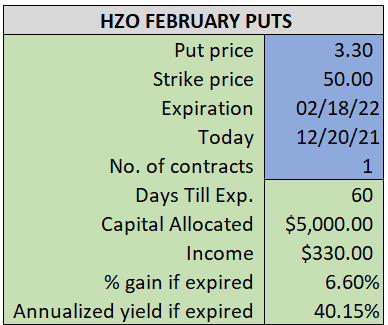

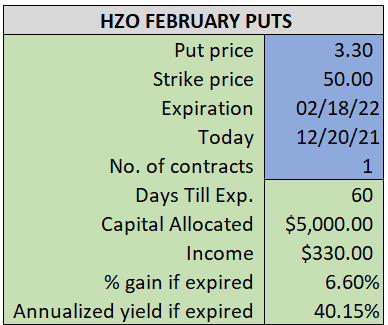

By selling the February $50 puts near $3.30, we’re able to collect an annualized yield near 40% while also giving us roughly $3.50 per share in cushion between the current market price for HZO and our strike price.

- Sell (to open) 1 HZO February 18th $50 put

- Limit: $3.30 or more

- The new position will represent roughly 5.5% of our model.

~~~~~~~~~~ - 10:30 Executed

- Sold 1 HZO Feb 18th $50 put @ $3.60