Selling CCJ puts for income.

Cameco Corp. (CCJ) is a uranium miner and the company should benefit from a focus on clean electricity.

A surge in electric vehicle production, along with political pressure to move away from fossil fuels towards renewable and clean energy is driving demand for nuclear energy. Since CCJ is one of the few pure plays on uranium, the stock will naturally trade higher as investors build exposure to this area.

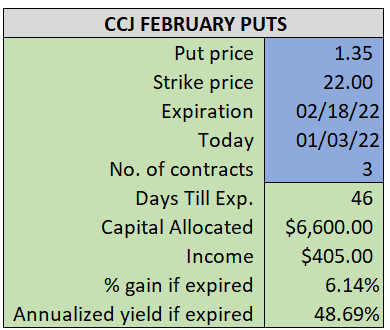

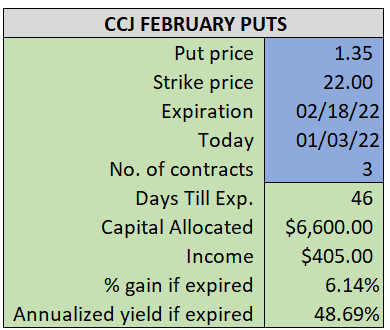

By selling the February $22 puts near $1.35, we’re able to collect an annualized yield near 48%, while also giving us roughly $1.10 per share in cushion between the current market price for CCJ and our strike price.

- Sell (to open) 3 CCJ February 18th $22 puts

- Limit: $1.35 or more

- The new position will represent roughly 6.6% of our model.

~~~~~~~~~ - 10:56 Executed

- Sold 3 CCJ Feb 18th $22 puts @ $1.36