Selling WYNN puts for income.

Wynn Resorts (CCJ) traded lower throughout 2021 as concerns about new variations of the coronavirus weighed on investors.

But now it is becoming clear that the omicron variant is much less deadly. Consumers are making plans to travel and Wynn’s business should improve throughout 2022. The stock has found support and recently started its rebound. I expect shares to trade higher throughout the year, making WYNN a great stock for collecting income payments.

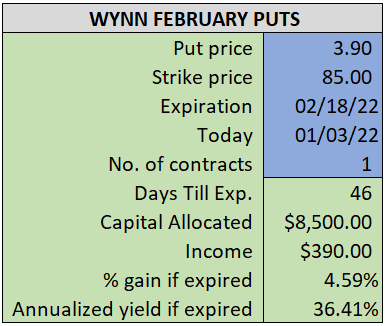

By selling the February $85 puts near $3.90, we’re able to collect an annualized yield near 36%, while also giving us roughly $3.50 per share in cushion between the current market price for WYNN and our strike price.

- Sell (to open) 1 WYNN February 18th $85 puts

- Limit: $3.90 or more

- The new position will represent roughly 8.5% of our model.

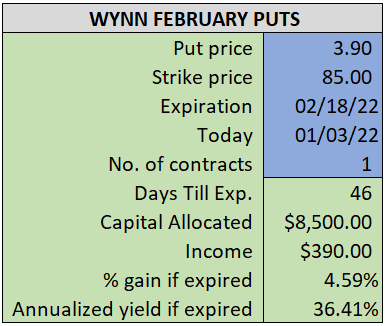

~~~~~~~~~ - 15:37 Executed

- Sold 1 WYNN Feb 18th $85 Put @ $4.08