Selling RBLX puts for income.

ROBLOX Corp. (RBLX) operates an online video game platform designed for children. The platform lets kids interact with each other, and allows developers to create their own unique gaming areas for users to enjoy.

The company is seen as one of the primary players in the “metaverse” and RBLX has been careful to set up its platform with safety for kids as a priority.

Given RBLX large and growing global reach, the stock will certainly be on tech investors radar for 2021. After falling from a November peak near $140, the stock appears to be finding support near $85. This is where the stock originally broke higher last fall, so the support area has a high-probability of holding.

Plus, thanks to the volatility in this name, our put-selling income strategy can collect an extra large income payment while still giving us plenty of buffer in case shares pull back.

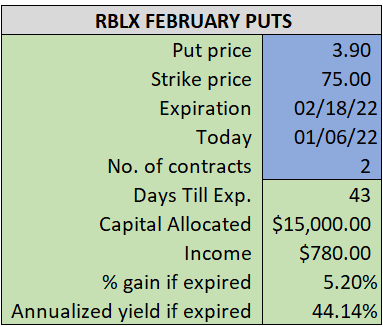

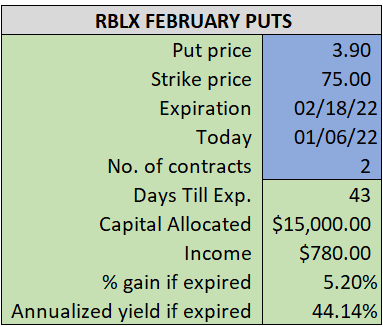

By selling the February $75 puts near $3.90, we’re able to collect an annualized yield near 44%, while also giving us roughly $15 per share in cushion between the current market price for RBLX and our strike price.

- Sell (to open) 1 RBLX February 18th $75 put

- Limit: $3.90 or more

- The new position will represent roughly 7.6% of our model.

~~~~~~~~~ - 11:17 Executed

- Sold 1 RBLX Feb 18th $75 Put @ $3.90