Selling CG puts for income.

The Carlyle Group (CG) is a private equity company that invests for some of the wealthiest pension funds and endowments.

I love the private equity business model which generates profits by charging management fees, incentive allocations, and by investing the firm’s capital alongside investors. CG is a well respected firm and should be able to grow assets as institutional investors look for areas outside the traditional stock market for building wealth.

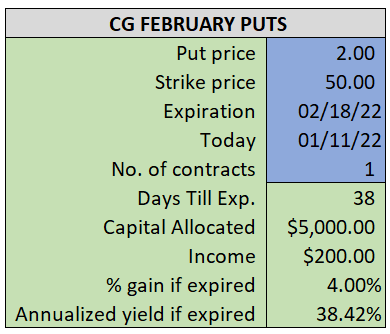

By selling the February $49 puts near $2.00, we’re able to collect an annualized yield near 38%, while also giving us roughly $1.00 per share in cushion between the current market price for CG and our strike price.

- Sell (to open) 1 CG February 18th $50 put*

- Limit: $2.00 or more*

- The new position will represent roughly 5.0% of our model.

~~~~~~~~~ - 10:26 Executed

- Sold 1 CG Feb 18th $50 Put @ $2.15

*A previous version had the wrong CG strike price and limit price.