Selling VIAC puts for income.

Viacom CBS (VIAC) had a very rough 2021 as the media company arguably fell behind many of its competitors. But the company is still very profitable, and is expected to earn $3.97 per share this year.

With the stock currently trading near $37, VIAC is clearly a value stock. Investors are paying less than 10 times expected earnings which is a discount to peers and the market in general.

Investors are moving capital out of growth names and into value stocks like VIAC. And that trend has started to push VIAC shares higher in 2022. This is a healthy sign of relative strength and gives us a good opportunity to use our instant income strategy to collect an attractive payment from this play.

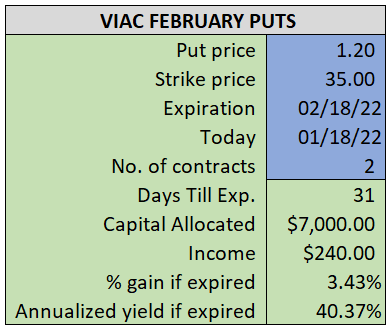

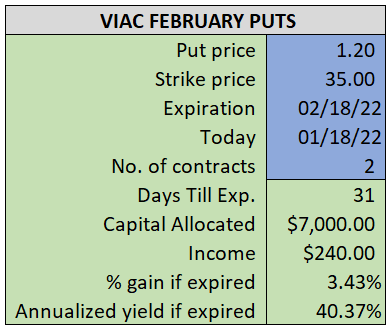

By selling the February $35 puts near $1.20, we’re able to collect an annualized yield near 40%, while also giving us roughly $2.00 per share in cushion between the current market price for VIAC and our strike price.

- Sell (to open) 2 VIAC February 18th $35 puts

- Limit: $1.20 or more

- The new position will represent roughly 7.0% of our model.

~~~~~~~~~ - 9:59 Executed

- Sold 2 VIAC Feb 18th $35 puts @ $1.29