Selling BROS puts for income.

Dutch Brothers (BROS) is a fast growing coffee chain headquartered in the Pacific Northwest.

The stock shot higher after the company’s IPO last year, but since then the shares have pulled back. BROS found support near $40 this week and could be a great buy here. Plus, thanks to the pullback, put prices have increased giving us a lucrative amount of income for this play.

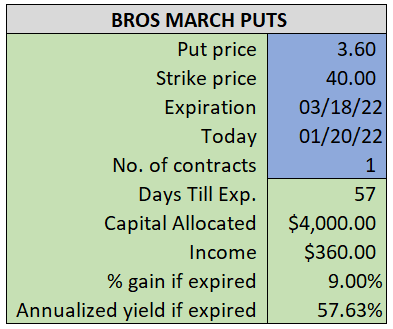

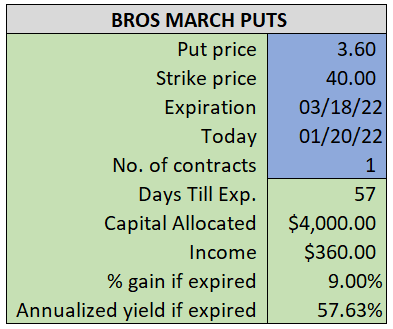

By selling the March $40 puts near $3.60, we’re able to collect an annualized yield near 58%, while also giving us roughly $3.50 per share in cushion between the current market price for BROS and our strike price.

- Sell (to open) 1 BROS March 18th $40 put

- Limit: $3.60 or more

- The new position will represent roughly 4.0% of our model.

~~~~~~~ - 13:46 Executed

- Sold 1 BROS March 18th $40 Put @ $3.80