Rolling our RCL puts to a higher strike price.

Shares of RCL are surging higher as the omicron variant dies out and travelers start booking cruises for the year ahead.

Now that the stock is trading higher, our February puts are much cheaper. So we can buy out of our agreement at a very low price. This allows us to lock in profits and free up cash.

We’ll then use that cash to set up a new income play by selling put contracts with a higher “strike price” (or agreement price). This way we can continue to generate income from shares of RCL.

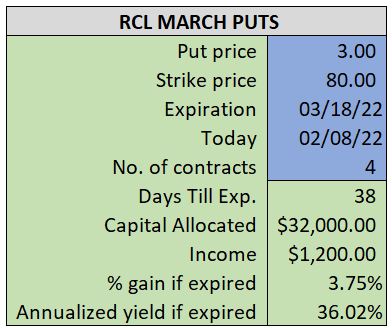

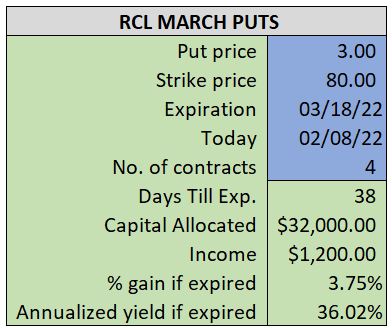

By selling the RCL March $80 puts near $3.00, we’re able to collect an annualized yield near 36%, while also giving us roughly $6.00 per share in cushion between the current market price for RCL and our strike price.

- Buy (to close) our RCL February 18th $75 put

- Limit: $0.40 or less

~~~~~~~~ - 14:11 Executed

- Bot 1 RCL Feb 18th $75 Put @ $0.36

ALSO

- Sell (to open) one RCL March 18th $80 put

- Limit: $3.00 or more

- The new position will represent roughly 8.1% of our model.

~~~~~~~ - 14:12 Executed

- Sold 1 RCL March 18th $80 Put @ $3.00