Selling WYNN puts for income.

Wynn Resorts (WYNN) is a reopening play that should benefit from an increase in travel. Shares traded lower during the coronavirus crisis and have yet to recover because investors are still worried about new variants.

At this point, the stock appears to be trading based on “worst case” expectations, with plenty of room for upside surprises. This helps our income strategy in two ways.

First, we can sell puts with a low “agreement price” with a healthy probability that the stock will not trade below that strike price.

And second, put prices are higher thanks to investor uncertainty. So by selling these put contracts, we can collect more income while taking less risk.

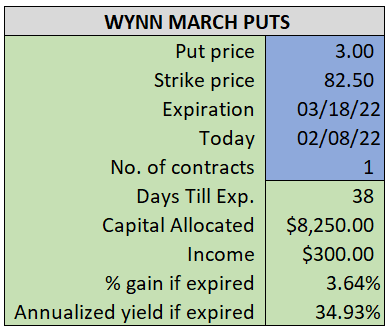

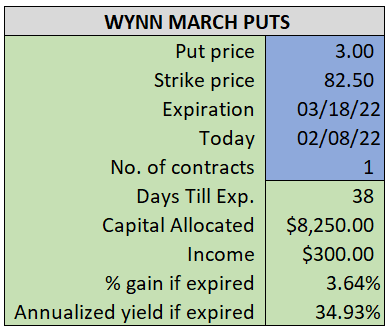

By selling the March $82.50 puts near $3.00, we’re able to collect an annualized yield near 35%, while also giving us roughly $6.00 per share in cushion between the current market price for WYNN and our strike price.

- Sell (to open) 1 WYNN March 18th $82.50 put

- Limit: $3.00 or more

- The new position will represent roughly 8.4% of our model.

~~~~~~~ - 10:08 Executed

- Sold 1 WYNN March 18th $82.50 put @ $3.15