Selling BHP puts for income.

BHP Group (BHP) is a natural resource company that produces iron ore, copper, oil, natural gas and more.

Resources like these are attractive as the global economy recovers. Manufacturing, transportation, construction and inflation all help to drive profits higher for BHP.

The stock has been moving higher this year and has plenty of tailwinds that should drive profits and the stock price higher. Plus, BHP is a value stock, trading at just over 10 times this year’s expected earnings.

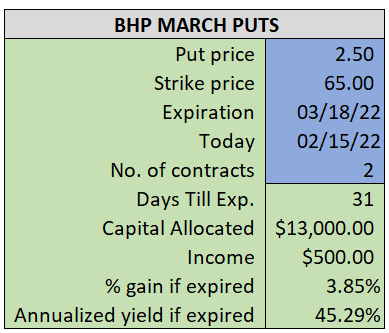

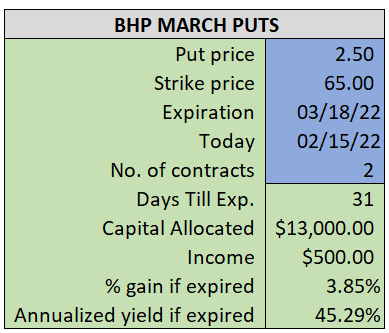

By selling the March $65 puts near $2.50, we’re able to collect an annualized yield near 45%, while also giving us roughly $2.00 per share in cushion between the current market price for BHP and our strike price.

- Sell (to open) 1 BHP March 18th $65 puts

- Limit: $2.50 or more

- The new position will represent roughly 6.5% of our model.

~~~~~~~ - 15:10 Executed

- Sold 1 BHP March $65 Put @ $2.65