“Investors cut positions and bought hedges in the run-up to the dramatic swings in recent days — one reason for the relative resilience of stock gauges when Russian forces launched its invasion.” ~Bloomberg

Remember the meme stock buyers intent on “sticking it to Wall Street” and hurting the evil short sellers?

Well, thank goodness they didn’t completely annihilate traders with bets against the market. Otherwise, stocks may not have rallied nearly as much over the last two trading days.

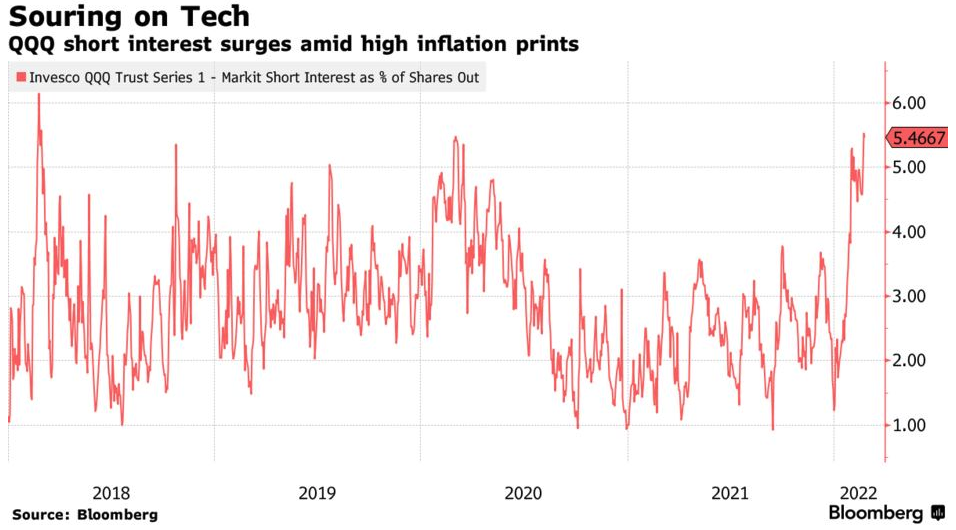

Take a look at the chart from Bloomberg below:

The graphic shows that midway through February, traders with bets against the Nasdaq 100 — via the Invesco QQQ Trust (QQQ) — made up roughly 5.5% of the open interest for the fund.

That’s the highest level of bearish positions in two years, matching the level seen at the height of the coronavirus crisis.

Some of these bearish bets may have been used to hedge existing long-term investments. And some of the bets were certainly outright speculation that stocks would drop.

Regardless of the reason for these positions, once the market started trading higher, the short interest became a liability instead of an asset. Traders were losing money on their bearish bets, giving them incentive to buy — and buy quickly!

That’s how a free market is supposed to work!

And it’s a perfect example of how “predators” in the market actually help to provide stability even during challenging periods.

Without these bearish bets, we wouldn’t have seen nearly as much strength at the end of last week. So remember this important role next time someone tells you that short sellers are “evil” or should be banned.

Long-term the stock market is healthier when allowed to trade freely with investors building positions on either side of the market based on their own research and expectations.

Switching gears, let’s take a look at some of the most important stories I’m watching as we kick off a new week of trading.

Tracking the Russia / Ukraine Invasion

- WSJ: Sanctions on Russia’s Central Bank deal direct blow.

- The U.S., Europe and Canada pledged to block Russian reserves.

- Actions will limit Russia’s ability to defend the ruble.

- The move will affect close to 40% of Russia’s financial reserves.

- Bloomberg: Russia works to defend its economy from curbs.

- Russia’s central bank more than doubled key interest rate to 20%.

- Russia also banned from selling securities held by foreigners.

- Frozen reserves will make cutting gas exports difficult for Russia.

- Reuters: Russia faces disruptions to oil without SWIFT.

- Exports of oil, metals, grains will be disrupted by West sanctions.

- Restrictions on Russia’s central bank’s international reserves coming.

- SWIFT restrictions can cause significant disruption to energy trade.

- S&P Global: Russian debt downgraded to junk territory.

- Sanctions could have significant effects on economic activity.

- Russia’s ability to act as financial facilitator for trade is challenged.

- Second round effects on domestic confidence could be substantial.

- AlJazeera: Russia, Ukraine and the global wheat supply.

- Russia accounts for more than 18% of international wheat exports.

- Combined with Ukraine, the two supply 1/4 of worlds wheat.

- Wheat is the second most produced grain in the world (after corn).

U.S. Economy: Inflation & Spending

- Bloomberg: Pending home sales fall by most in 11 months.

- January home sales decreased 5.7% from the previous month.

- Homebuyers are still struggling thanks to low inventory.

- High prices and mortgage rates are cutting into affordability.

- WSJ: Fed’s preferred inflation measure highest since 1983.

- Core personal consumption expenditures rose 5.2% in January.

- Oil prices surged to 7-year highs.

- Housing costs represent 1/5 of the core PCE index.

- WSJ: Consumer Spending rose 2.1% in January.

- Adjusting for inflation, spending was up 1.5% while income was down.

- Some of the increase ties to higher prices for gas and other staples.

- With spending picking up, the U.S. savings rate fell to 6.4%.

Energy Markets Continue to Surge

- Bloomberg: Iraq shuts down two oil fields.

- Protests caused Iraq to shut down two major oilfields.

- Many OPEC members have struggled to reach production quotas.

- As Russian oil comes off the market, other sources can’t keep up.

- Reuters: OPEC+ trims forecast for 2022 oil market surplus.

- OPEC+ revised 2022 oil surplus forecast by 200,000 barrels per day.

- The group which includes Russian allies is set to meet on March 2.

- Developed world oil inventories expected below average this year.

- Bloomberg: Surging oil is a boon for Middle East budgets.

- Oil is above the break-even level for almost all Mid East producers.

- Saudi Arabia needs oil at about $72 to balance its budget.

- The rise in oil will support the economic recover of Gulf countries.

- Reuters: U.S. drillers scramble to find sand for fracking.

- U.S. oil drillers are trying to boost output, profiting from high prices.

- A shortage of sand for fracking operations makes this difficult.

- Prices for sand are between $50 and $70 a ton, vs $20-$25 last year.