Selling BROS puts and DAL puts for income.

Last week’s consumer spending report beat expectations, and business travel is starting to pick back up.

Both of these data points are great news for Dutch Bros (BROS) — a West Coast coffee retailer — and Delta Airlines (DAL).

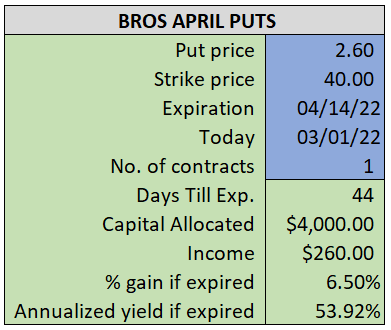

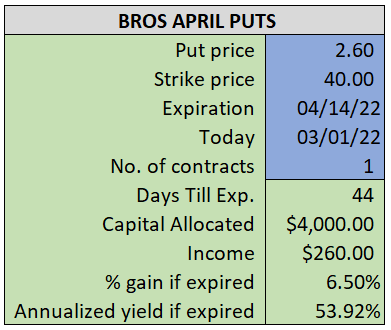

By selling the BROS April $40 puts near $2.60, we’re able to collect an annualized yield near 54%, while also giving us roughly $7.80 per share in cushion between the current market price for BROS and our strike price.

- Sell (to open) 1 BROS April 14th $40 put

- Limit: $2.60 or more

- The new position will represent roughly 4.1% of our model.

~~~~~~~ - 9:57 Executed

- Sold 1 BROS April 14th $40 Put @ $2.60

ALSO

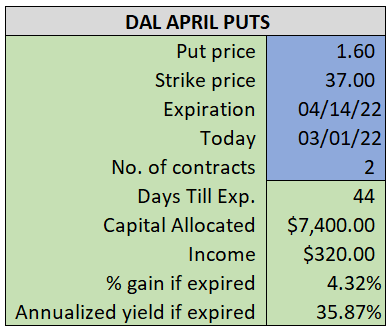

By selling the DAL April $37 puts near $1.60, we’re able to collect an annualized yield near 36%, while also giving us roughly $2.30 per share in cushion between the current market price for DAL and our strike price.

- Sell (to open) 2 DAL April 14th $37 puts

- Limit: $1.60 or more

- The new position will represent roughly 7.5% of our model.

~~~~~~~ - 9:57 Executed

- Sold 2 DAL Apr 14th $37 Puts @ $1.80