Selling CCJ puts for income.

Cameco Corp. (CCJ) is a uranium miner benefiting from higher energy prices and a shift toward nuclear power production.

The stock pulled back to start the year but has since rebounded. The Russia / Ukraine conflict is helping to drive home the necessity of a diversified energy base which ultimately could drive much more demand for nuclear power.

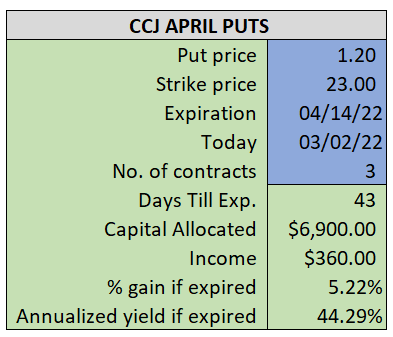

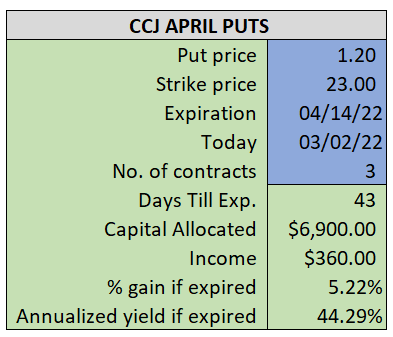

By selling the April $23 puts near $1.20, we’re able to collect an annualized yield near 44%, while also giving us roughly $2.00 per share in cushion between the current market price for CCJ and our strike price.

- Sell (to open) 3 CCJ April 14th $23 puts

- Limit: $1.20 or more

- The new position will represent roughly 7.2% of our model.

~~~~~~~ - 10:35 Executed

- Sold 3 CCJ April 14th $23 Puts @ $1.30