Selling MARA puts for income.

Marathon Digital (MARA) is a crypto mining company that uses a fleet of computer servers to perform blockchain transactions and mine new Bitcoin tokens.

Cryptocurrencies have pulled back but are starting to find support. Meanwhile, MARA has bounced at the $20 per share level twice and investors are starting to have more confidence in this company.

Thanks to higher volatility for Bitcoin and this stock in particular, we’re able to collect a larger than average payment from these put contracts, while still taking advantage of a meaningful margin of safety.

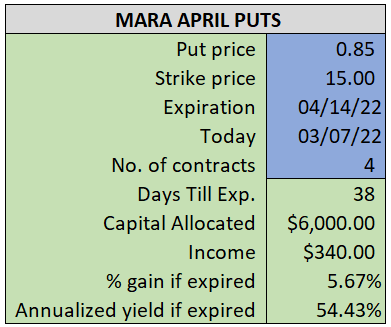

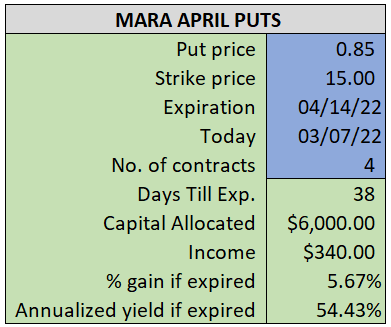

By selling the April $15 puts near $0.85, we’re able to collect an annualized yield near 54%, while also giving us roughly $7.50 per share in cushion between the current market price for MARA and our strike price.

- Sell (to open) 4 MARA April 14th $15 puts

- Limit: $0.85 or more

- The new position will represent roughly 6.3% of our model.

~~~~~~~ - 10:49 Executed

- Sold 4 MARA April 14th $15 Puts @ $0.93