Selling NTES puts for income.

Netease (NTES) is a profitable Chinese web portal similar to Amazon.com in the West.

Chinese stocks have been under severe pressure this year as political tensions rise and following a crackdown on profitable businesses by the Chinese government.

Recently, Chinese authorities have signaled that the period of heightened regulation will likely ease. China doesn’t want to risk damaging its own economy by adding too many restrictions.

NTES should trade higher in the wake of reduced regulations. As traders rebuild exposure to China, I expect NTES to be one of the primary names that attracts capital.

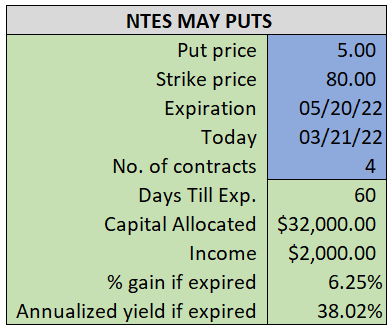

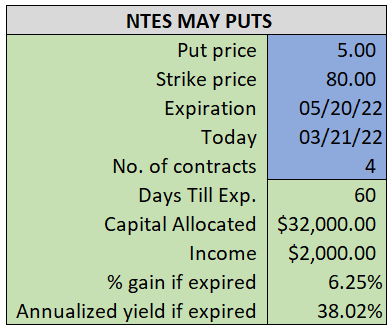

Thanks to the recent volatility, we can collect a lucrative payment from NTES.

By selling the May $80 puts near $5.00, we’re able to collect an annualized yield near 38%, while also giving us roughly $10.00 per share in cushion between the current market price for NTES and our strike price.

- Sell (to open) 1 NTES May 20th $80 put

- Limit: $5.00 or more

- The new position will represent roughly 8.2% of our model.

~~~~~~~ - 11:26 Executed

- Sold 1 NTES May 20th $80 Put @ $5.28