Selling Z puts for income.

Zillow Group (Z) operates an online platform for potential homebuyers and real estate agents.

In today’s hot housing market, Zillow should be able to capitalize on advertising opportunities.

The stock is off sharply from last year’s highs, due partly to the company’s failed foray into buying and selling actual real estate positions. Also, Zillow traded lower as high-priced internet and tech stocks sold off.

Earlier this month, we sold May $40 put contracts for this stock, collecting a lucrative income payment. Since then, the stock moved higher and we were able to close out that play for a profit.

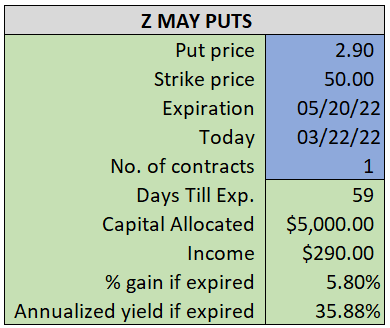

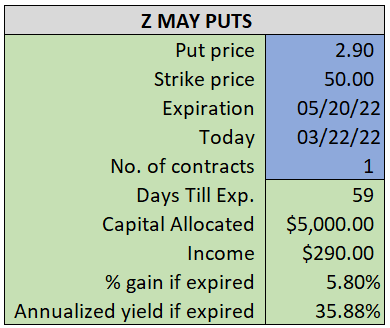

Today we’ll enter a new income play using the May $50 strike price. This gives us an attractive amount of income on a stock that has begun to build positive momentum.

By selling the May $50 puts near $2.90, we’re able to collect an annualized yield near 36%, while also giving us roughly $6.30 per share in cushion between the current market price for Z and our strike price.

- Sell (to open) 1 Z May 20th $50 put

- Limit: $2.90 or more

- The new position will represent roughly 5.1% of our model.

~~~~~~~ - 15:03 Executed

- Sold 1 Z May 20th $50 Put @ $2.95