Selling CHPT puts for income.

ChargePoint Holdings (CHPT) operates a network of electric vehicle charging stations that features a cloud subscription program for members.

Higher oil prices make the case for electric vehicles a bit stronger. So the recent turbulence for traditional energy prices has led investors to start putting capital back into stocks tied to the EV market.

While CHPT is not yet profitable, the stock has pulled back to a more reasonable level this year. And given the growing market for EVs, the company could wind up being a takeover target this year.

Volatility in the stock has led to higher option prices, which gives us a chance to collect more lucrative income payments while still managing our risk.

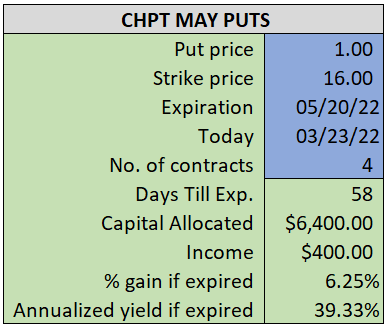

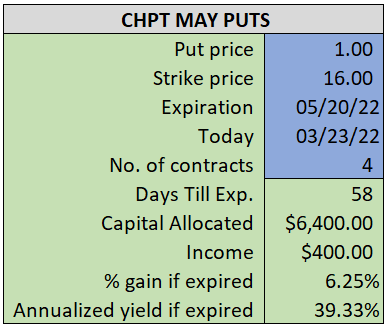

By selling the May $16 puts near $1.00, we’re able to collect an annualized yield near 39%, while also giving us roughly $2.50 per share in cushion between the current market price for CHPT and our strike price.

- Sell (to open) 4 CHPT May 20th $16 puts

- Limit: $1.00 or more

- The new position will represent roughly 6.6% of our model.

~~~~~~ - 10:36 Executed

- Sold 4 CHPT May 20th $16 Puts @ $1.06