Selling YETI puts for income.

Yeti Holdings (YETI) is an outdoor leisure merchandise company famous for their insulated coolers and similar items.

The U.S. consumer is still in good shape with plenty of discretionary spending money. And since YETI caters to more affluent consumers, the company has more pricing power than many other retailers.

This means YETI should be able to pass on inflationary costs and maintain profit margins.

It also helps that supply chain challenges appear to be easing, giving companies like YETI the ability to import merchandise in time for peak outdoor season here in the U.S.

Shares pulled back for much of the last few months, but appear to have found support near $55. The company’s profits remain stable and are expected to grow significantly over the next two years.

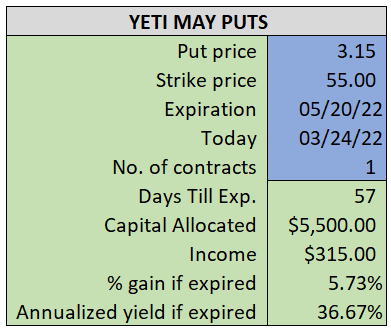

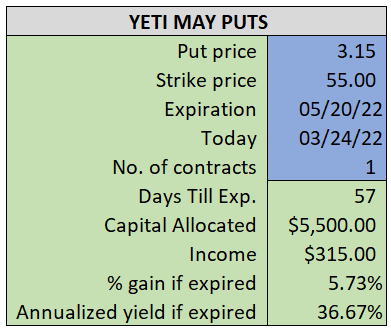

By selling the May $55 puts near $3.15, we’re able to collect an annualized yield near 37%, while also giving us roughly $3.30 per share in cushion between the current market price for YETI and our strike price.

- Sell (to open) 1 RUN May 20th $55 put

- Limit: $3.15 or more

- The new position will represent roughly 5.6% of our model.

~~~~~~~ - 14:51 Executed

- Sold 1 RUN May 20th $55 Put @ $3.20