Selling SSRM puts for income.

SSR Mining (SSRM) is a precious metal mining company that benefits from higher gold and silver prices.

Rising inflation has driven more investor interest in precious metals, helping gold and silver approach all-time highs.

However, this morning’s potentially good news on possible peace talks between Russia and Ukraine has caused oil prices to pull back. This gives investors a bit of hope that inflation will subside.

Even considering the possibility for peace between Russia and Ukraine, inflation is still a concern and I expect gold and silver prices to rise throughout the year.

So even though gold and silver pulled back a bit this morning, the long-term bullish trend should continue.

The pullback gives us a chance to set up an attractive income play before the bullish trend continues.

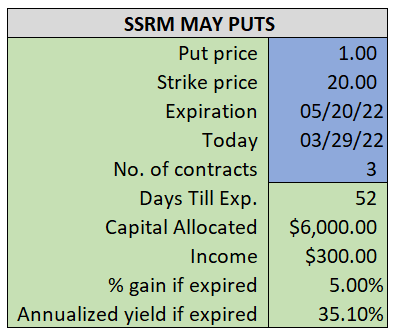

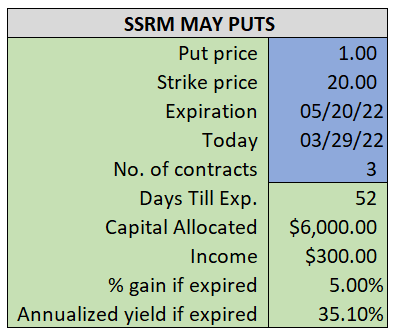

By selling the May $20 puts near $1.00, we’re able to collect an annualized yield near 35%, while also giving us roughly $0.75 per share in cushion between the current market price for SSRM and our strike price.

- Sell (to open) 3 SSRM May 20th $20 puts

- Limit: $1.00 or more

- The new position will represent roughly 6.1% of our model.

~~~~~~~ - 9:58 Executed

- Sold 3 SSRM May 20th $20 Puts @ $1.00