Selling CHPT puts for income.

ChargePoint Holdings (CHPT) manages a network of charging stations for electric vehicles. The company’s cloud-based subscription platform makes it easier for drivers fo find and connect with local charging stations across the U.S. and Europe.

While the company is not yet profitable, strong demand for electric vehicles should continue to drive investor interest in this stock. Higher oil and gasoline prices also help to accelerate the shift towards more electric vehicles.

The stock is trending higher, and already gave us a chance to lock in an attractive income play earlier in the year. Today we’ll set up a new income play using put contracts with a slightly higher strike price.

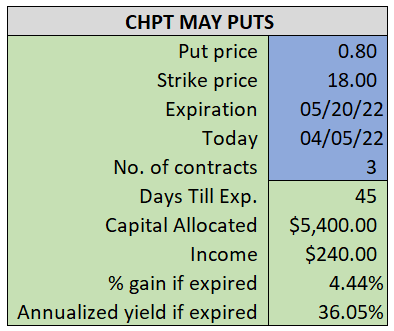

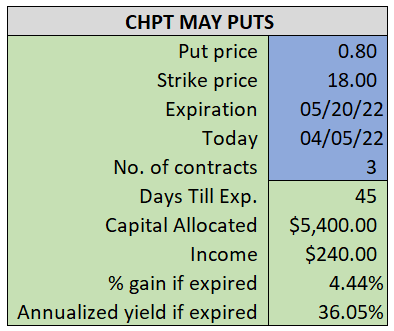

By selling the May $18 puts near $0.80, we’re able to collect an annualized yield near 36%, while also giving us roughly $2.20 per share in cushion between the current market price for CHPT and our strike price.

- Sell (to open) 3 CHPT May 20th $18 puts

- Limit: $0.80 or more

- The new position will represent roughly 5.5% of our model.

~~~~~~~ - 10:58 Executed

- Sold 3 CHPT May 20th $18 Puts @ $0.90