Selling NCLH puts for income.

Norwegian Cruise Lines (NCLH) is trading higher today alongside other travel stocks. Delta Air Lines kicked off earnings season today with a strong report that shows consumer travel is picking up.

Cruise lines should benefit from strong demand following two years of covid-restricted travel. The stock has held up well this month despite weakness in other areas of the market.

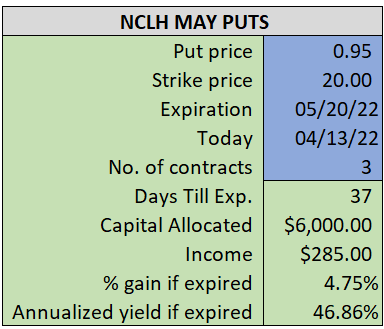

By selling the May $20 puts near $0.95, we’re able to collect an annualized yield near 47%, while also giving us roughly $1.40 per share in cushion between the current market price for NCLH and our strike price.

- Sell (to open) 3 NCLH May 20th $20 puts

- Limit: $0.95 or more

- The new position will represent roughly 6.1% of our model.

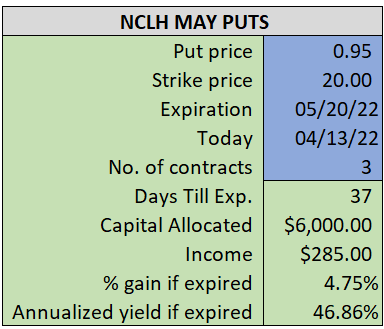

~~~~~~~ - 15:05 Executed

- Sold 3 NCLH May 20th $20 Puts @ $1.00