Selling WYNN puts for income.

Wynn Resorts (WYNN) is oversold and should benefit from any bear market rally.

Investors are worried that Chinese lockdowns will hurt profits at the company’s Macau locations. But these fearful investors aren’t placing much value on WYNN’s other properties that should benefit from the global reopening.

Wynn is expected to lose money again in 2022. But Wall Street is expecting a profit of $2.48 per share next year. At this point, investors appear to be fully aware of the bad news, and any positive news could sent the stock sharply higher.

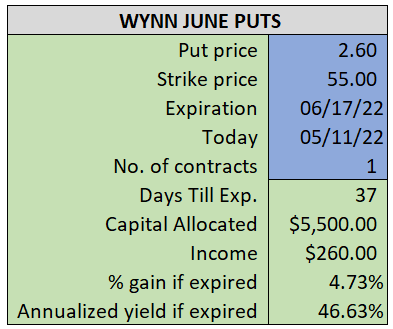

By selling the June $55 puts near $2.60, we’re able to collect an annualized yield near 47%, while also giving us roughly $5.00 per share in cushion between the current market price for WYNN and our strike price.

- Sell (to open) 1 WYNN June 17th $55 put

- Limit: $2.60 or more

- The new position will represent roughly 6.3% of our model.

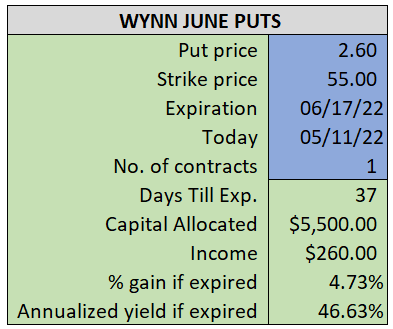

~~~~~~~ - 13:05 Executed

- Sold 1 WYNN June 17 $55 Put @ $2.97