Selling CG puts for income.

The Carlyle Group (CG) a private equity company that manages investments for large endowments, pension plans and affluent individuals.

Shares have traded lower this year as the broad market decline has pushed asset values lower. But the overall market is now oversold and due for a rebound.

Meanwhile, CG will continue to profit from investment fees that are charged whether the firm’s investments perform well or not. The stock also pays a 3.6% dividend yield which should attract new investors and keep the stock from falling much lower.

In short, we’re able to pick up an attractive income payment, taking advantage of a short-term pullback for this quality stock.

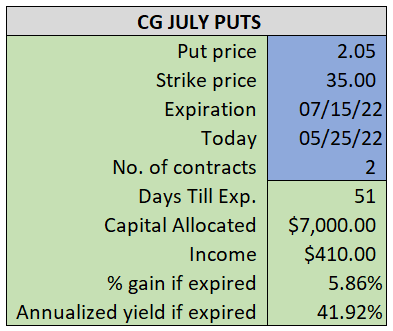

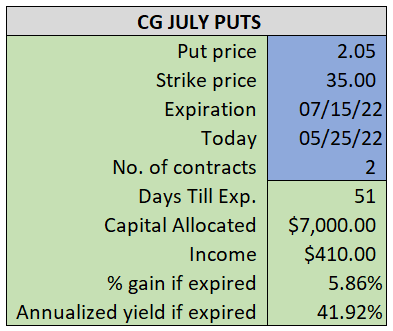

By selling the July $35 puts near $2.05, we’re able to collect an annualized yield near 42%, while also giving us roughly $0.60 per share in cushion between the current market price for CG and our strike price.

- Sell (to open) 2 CG July 15th $35 puts

- Limit: $2.05 or more

- The new position will represent roughly 7.9% of our model.

~~~~~~ - 10:20 Executed

- Sold 2 CG July 15th $35 Puts @ $2.12