Rolling our BABA puts to a higher strike price and July contract.

Shares of BABA are moving sharply higher as the bear market rally gets underway.

Chinese internet stocks have come under extreme pressure thanks to tighter regulations from China’s politicians.

But now, China’s leadership is becoming more concerned about an economic pullback. This is leading to a more friendly business climate and should help shares of profitable Chinese companies like BABA move higher over the next several months.

Now that the stock is trading higher, our June $75 puts are much cheaper. So we can buy out of our agreement at a very low price. This allows us to lock in profits and free up cash.

We’ll then use that cash to set up a new income play by selling put contracts with a higher “strike price” (or agreement price). This way we can continue to generate income from shares of BABA.

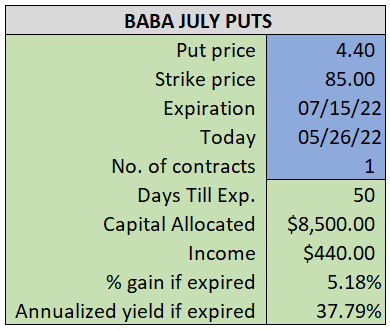

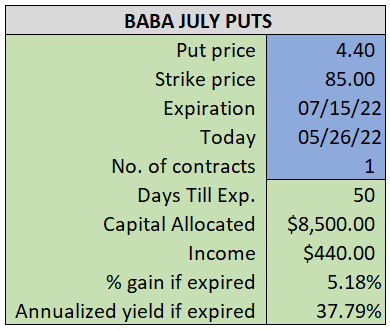

By selling the BABA July $85 puts near $4.40, we’re able to collect an annualized yield near 38%, while also giving us roughly $10.00 per share in cushion between the current market price for BABA and our strike price.

- Buy (to close) our BABA June 17th $75 put

- Limit: $0.90 or less

~~~~~~~ - 14:03 Executed

- Bot BABA June 17th $75 Put @ $.87

ALSO

- Sell (to open) one BABA July 15th $85 put

- Limit: $4.40 or more

- The new position will represent roughly 9.5% of our model.

~~~~~~~ - 14:04 Executed

- Sold 1 BABA July 15th $85 Put @ $4.55