Selling CLF puts and APA puts for income.

As inflation continues, we’re in a bull market for commodities. This inflation benefits companies that produce natural resources like oil and also industrial metals.

Cleveland-Cliffs Inc. (CLF) is a U.S. steel producer with a significant advantage. The company has its own iron ore mines in the Great Lakes region. So instead of buying iron ore at inflated prices from China, CLF is able to keep its costs low and profit margins wide.

APA Corp (APA) produces oil and natural gas. The stock has been trending higher, but pulled back slightly during today’s trading session. We’ll use this pullback as an opportunity to set up a new income play for APA.

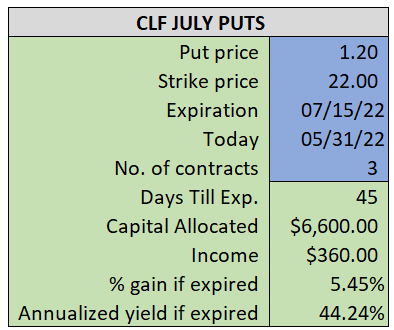

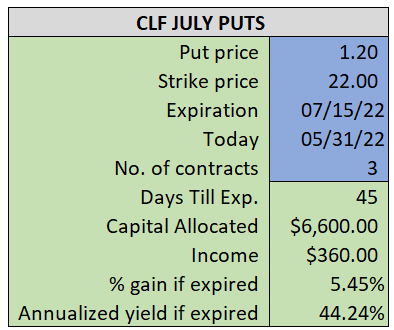

By selling the CLF July $22 puts near $1.20, we’re able to collect an annualized yield near 44%, while also giving us roughly $1.40 per share in cushion between the current market price for CLF and our strike price.

- Sell (to open) 3 CLF July 15th $22 puts

- Limit: $1.20 or more

- The new position will represent roughly 7.3% of our model.

~~~~~~~ - 14:54 Executed

- Sold 3 CLF July 15th $22 Puts @ $1.35

ALSO

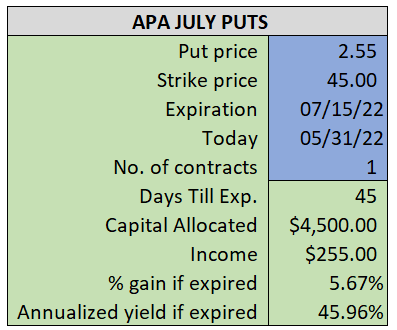

By selling the APA July $45 puts near $2.55, we’re able to collect an annualized yield near 46%, while also giving us roughly $1.75 per share in cushion between the current market price for APA and our strike price.

- Sell (to open) 1 APA July 15th $45 put

- Limit: $2.55 or more

- The new position will represent roughly 5.0% of our model.

~~~~~~~~ - 14:54 Executed

- Sold 1 APA July 15th $45 Put @ $2.95