Selling JD puts for income.

JD.com Inc. (JD) is a Chinese e-commerce website that stands to benefit from improving sentiment for Chinese stocks.

Shares of popular Chinese companies have traded lower this year. Investors are worried about anti-capitalism policies and also about covid restrictions that are hampering economic growth.

But policymakers in China now appear to be more concerned about the economic consequences of these strategies. Restrictions are finally lifting and investor sentiment is improving.

This creates a helpful backdrop for shares of JD.

I expect the stock to trade higher this summer.

Meanwhile, recent volatility has caused prices for put contracts to trade higher. This gives us a chance to collect more income while still leaving plenty of buffer between our agreement price and where the stock is trading today.

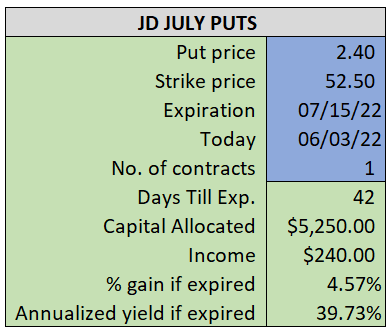

By selling the July $52.50 puts near $2.40, we’re able to collect an annualized yield near 40%, while also giving us roughly $3.60 per share in cushion between the current market price for JD and our strike price.

- Sell (to open) 1 JD July 15th $52.50 put

- Limit: $2.40 or more

- The new position will represent roughly 5.8% of our model.

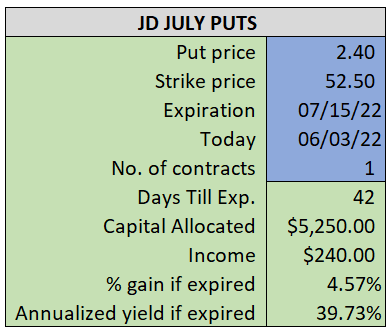

~~~~~~~ - 10:41 Executed

- Sold 1 JD Jul 15th $52.50 Put @ $2.66