Selling YETI puts for income.

Yeti Holdings (YETI) manufactures coolers, insulated tumblers and other goods for outdoor enthusiasts.

This past week, research firm Bespoke Investment Group noted unusually strong search activity for outdoor leisure topics. This is a good sign for retailers like YETI and could lead to positive revenue surprises this summer.

Meanwhile, YETI’s pullback has now brought the stock back to an attractive valuation. Shares trade near $47 — which is just about 13.5 times next year’s expected profits.

The stock appears to be ready to bounce as investors move capital into value plays and away from speculative tech stocks.

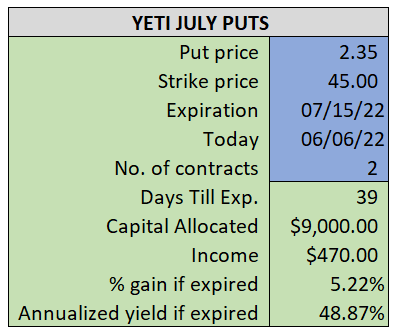

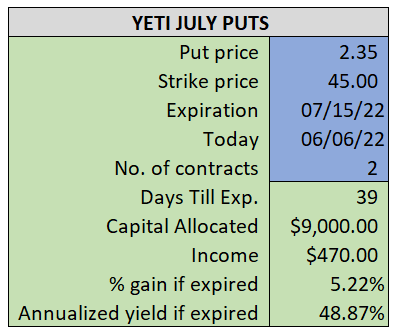

By selling the July $45 puts near $2.35, we’re able to collect an annualized yield near 49%, while also giving us roughly $2.00 per share in cushion between the current market price for YETI and our strike price.

- Sell (to open) 2 YETI July 15th $45 puts

- Limit: $2.35 or more

- The new position will represent roughly 9.9% of our model.

~~~~~~~ - 12:01 Executed

- Sold 2 YETI Jul 15th $45 Puts @ $2.43