Selling SSRM puts for income.

SSRM Mining (SSRM) is a gold and silver mining company that should benefit from the current inflationary environment.

While gold and silver have been off investors’ radar for much of the last 2 years, prices are now moving higher in response to today’s high inflation print.

I expect precious metals to trade much higher, driving shares of miners like SSRM up.

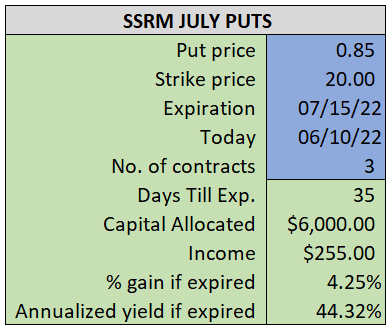

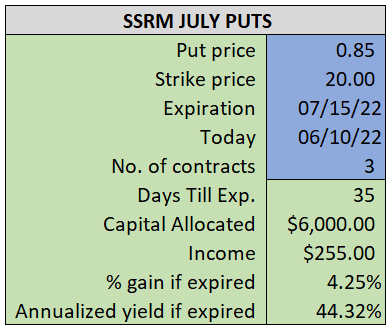

By selling the July $20 puts near $0.85, we’re able to collect an annualized yield near 44%, while also giving us roughly $0.60 per share in cushion between the current market price for SSRM and our strike price.

- Sell (to open) 3 SSRM July 15th $20 puts

- Limit: $0.85 or more

- The new position will represent roughly 6.8% of our model.

~~~~~~ - 14:27 Executed

- Sold 3 SSRM July 15th $20 Puts @ $0.85