Rolling our AMD puts to a higher strike price and August contract.

Shares of AU found support and now appear ready to move higher.

As supply chain disruptions begin to ease, computer chip companies like AMD are better able to manufacture, sell and ship product to their biggest customers.

I continue to be bullish on this stock. The most recent rally gives us a chance to close out our July put contracts while locking in the majority of income we received from entering this trade.

We’ll then use that cash to set up a new income play by selling August put contracts with a higher “strike price” (or agreement price). This way we can continue to generate income from shares of AMD.

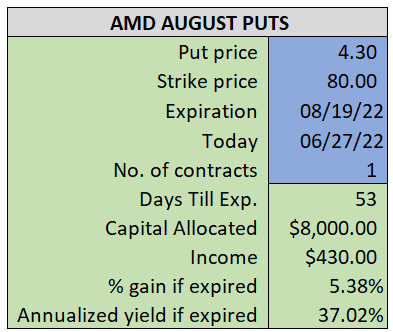

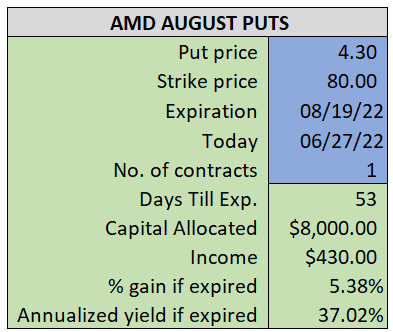

By selling the AMD August $80 puts near $4.30, we’re able to collect an annualized yield near 37%, while also giving us roughly $7.20 per share in cushion between the current market price for AMD and our strike price.

- Buy (to close) our AMD July 15th $75 put

- Limit: $0.85 or less

~~~~~~ - 12:12 Executed

- Bot AMD Jul 15th $75 Put @ $0.83

ALSO

- Sell (to open) one AMD August 19th $80 put

- Limit: $4.30 or more

- The new position will represent roughly 9.2% of our model.

~~~~~~ - 12:12 Executed

- Sold AMD Aug 19th $80 Put @ $4.45