Selling JD puts for income.

JD.com Inc. (JD) is a Chinese e-commerce site similar to Amazon.com in the U.S..

Chinese stocks were under pressure earlier this year, largely due to political pressure from the Chinese communist party.

But now that the pressure is causing economic pain, China is starting to lift restrictions giving more room for companies like JD to expand.

JD is a very profitable company and the stock is trading for a very reasonable price given the company’s expected growth. A recent pullback in the context of an overall recovery gives us a great chance to collect a lucrative income payment.

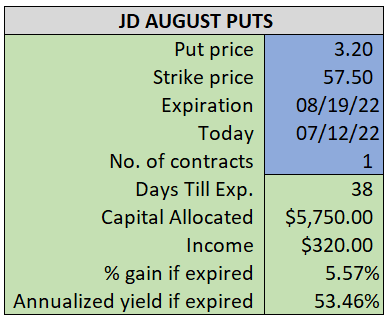

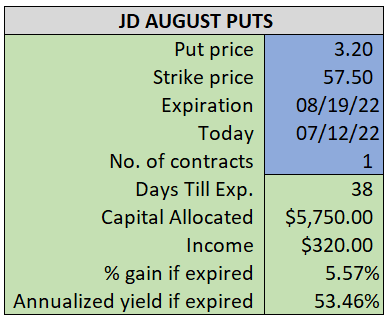

By selling the August $57.50 puts near $3.20, we’re able to collect an annualized yield near 53%, while also giving us roughly $3.00 per share in cushion between the current market price for JD and our strike price.

- Sell (to open) 1 JD August 19th $57.50 put

- Limit: $3.20 or more

- The new position will represent roughly 6.8% of our model.

~~~~~~~~ - 13:33 Executed

- Sold 1 JD August 19th $57.50 Put @ $3.30