Selling BIG puts for income.

Big Lots Inc. (BIG) is a discount retail store that sells to budget-conscious shoppers.

The company’s business model is to buy excess merchandise from more traditional retailers at deeply discounted prices. This allows BIG to sell merchandise at attractive prices while still generating reasonable profits.

BIG had trouble sourcing cheap merchandise over the past year. Supply chains were constrained and excess inventory was difficult to find.

But now, merchants have too much merchandise which bodes well for BIG’s business model.

The stock is cheap, trading for just over 10 times next year’s expected profits. And shares have started moving higher after hitting a low earlier this month.

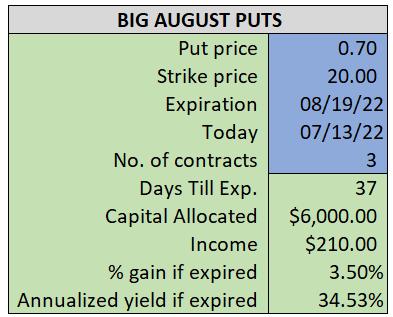

By selling the August $20 puts near $0.70, we’re able to collect an annualized yield near 35%, while also giving us roughly $2.80 per share in cushion between the current market price for BIG and our strike price.

- Sell (to open) 3 BIG August 19th $20 puts

- Limit: $0.70 or more

- The new position will represent roughly 7.1% of our model.

~~~~~~~~ - 10:59 Executed

- Sold 3 BIG August 19th $20 Put @ $0.715