Selling MS puts for income.

Morgan Stanley (MS) traded sharply lower this morning after the blue-chip bank reported earnings.

While bank earnings reports have raised some concerns about potential loan losses, shares of MS climbed higher throughout the day.

This is a sign that investors may have already “priced in” these concerns and are now ready to look ahead towards better times.

Put another way, if MS held its ground on bad news, it could trade sharply higher on any GOOD news.

I don’t expect MS to revisit today’s lows any time soon. Which makes the stock a good candidate for our put-selling income straetgy.

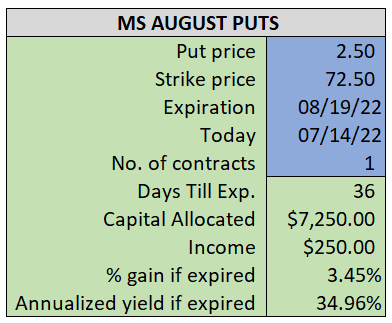

By selling the August $72.50 puts near $2.50, we’re able to collect an annualized yield near 35%, while also giving us roughly $2.30 per share in cushion between the current market price for MS and our strike price.

- Sell (to open) 1 MS August 19th $72.50 put

- Limit: $2.50 or more

- The new position will represent roughly 8.6% of our model.

~~~~~~~~ - 15:31 Executed

- Sold 1 MS August 19th $72.50 Put @ $2.51