Selling XPO puts for income.

XPO Logistics (XPO) is a trucking and logistics company helping to ease supply chain issues in our economy.

The company generates reliable profits and should continue to do well even in a challenging economic environment.

Shares are very cheap compared to earnings. Investors have been worried about the possibility of a recession, and many sold XPO ahead of these fears.

Now, the stock offers investors a true value. This is at a time when inflation fears are set to ease and investors are loading up on value stocks.

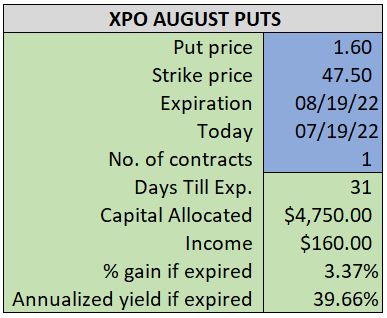

By selling the August $47.50 puts near $1.60, we’re able to collect an annualized yield near 40%, while also giving us roughly $3.70 per share in cushion between the current market price for XPO and our strike price.

- Sell (to open) 1 XPO August 19th $47.50 put

- Limit: $1.60 or more

- The new position will represent roughly 5.6% of our model.

~~~~~~~~ - 11:25 Executed

- Sold 1 XPO August 19th $47.50 put @ $1.67