I’m becoming more impressed with this bull market — and today I wanted to pass on some of the best advice I received when I was a young hedge fund manager.

“Zach, you need to learn to sit on your hands.”

That’s it!

That’s the advice I got from Bill — my boss and mentor — and one of the most successful investors I’ve ever known.

His advice came after reviewing my trading account for the previous week — and noticing that I was “over-trading” (in his words).

You see, when I had a position that moved higher, I quickly sold it to lock in profits.

Then I went on the hunt for a NEW stock to try to repeat the process.

And while I posted a profitable week, I lost out on what could have been some terrific profits.

All because I decided to sell out of my positive stocks too early.

Here’s what I should have done…

“If It’s Working, Buy More!”

Instead of quickly selling to lock in a small gain, Bill wanted to see me BUYING MORE to build a larger position.

In fact, Bill kept post-it notes and index cards throughout the office with one simple message:

“If it’s working, BUY MORE!!“

Here’s the reasoning Bill used.

Stocks trade higher because there’s something good happening:

- Earnings are expanding…

- The economy is growing…

- Investors are trying to build larger positions…

- Stimulus programs are kicking in…

- Or any number of other positive reasons.

Most of the time, these reasons continue to drive stock prices higher — for a longer period than we might expect.

Sure, all good things must come to an end. And you should be vigilant and watch for a shift in momentum.

But as long as the momentum is in place, the odds favor a continuation of that trend.

So if you have a position that is working well, it’s best to either buy more — or at the very least, sit on your hands and let it continue to run.

A Few “Extended” Stocks I’m Holding

Let’s take a look at a couple of real-world examples:

Shares of RH (RH) — formerly “Restoration Hardware” — rallied more than 50% over the last few weeks:

My Speculative Trading Program has a long position that continues to profit from this surge.

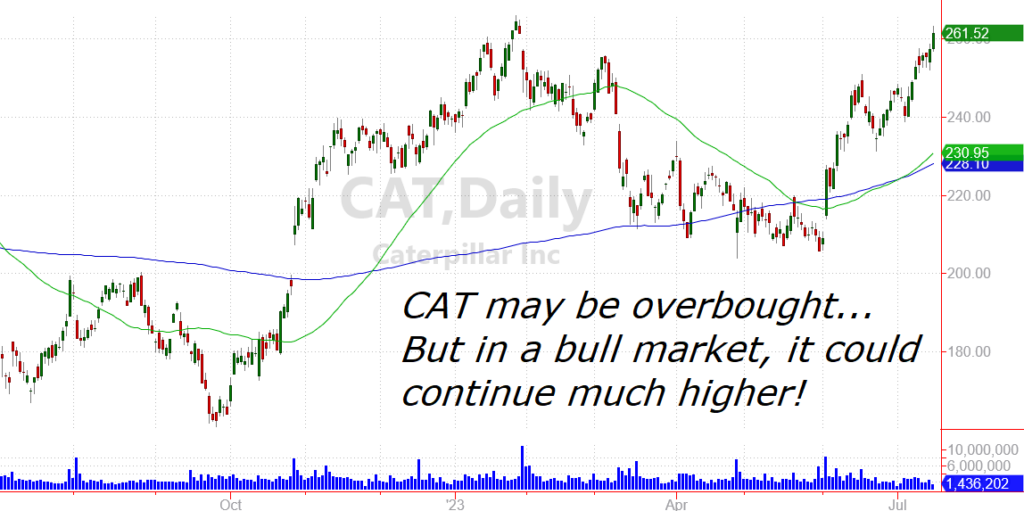

Caterpillar Inc. (CAT) is another good example. The stock is just a few bucks away from a new all-time high. And I’m keeping my bullish position as industrial stocks continue to outperform.

Full disclosure, I have a personal position in both of these stocks — via option contracts. And there are a number of other “extended” stocks in my account including Meta Platforms (META) and O’Reilly Automotive (ORLY).

Each day I see these stocks trending higher, I’m tempted to close the positions and lock in my profits.

And to be fair, there ARE some option strategies I use to lock in profits — while still keeping the positions in play.

But as I watch this bull market evolve, I continue to hear Bill’s advice ringing in my ears.

“Zach, don’t overtrade your account… If it’s working, buy more… And for goodness sake, sit on your hands and let your winners run!”

If you would like to see the aggressive trades I’m holding in my own account, I invite you to try out the Speculative Trading Program.

Members receive real time email alerts (and optional text alerts) any time I buy or sell a position. That way you can see exactly what I’m trading in my own account, and you can follow along in your own account.

For only $147 a month, this program can be a great tool for uncovering new ideas and locking in profits in today’s bull market.

>>Check out the Trading Program here<<

Here’s to growing and protecting your wealth!

Zach