This weekend I took an impromptu trip to visit a client who lives in Las Vegas.

And what an experience it turned out to be! I even wound up sleeping in a conference room!

No, I don’t have a scandalous Vegas story to share.

But wow… The whole trip caught me off guard. And it helped to confirm some of the exciting opportunities I’m seeing in the market right now.

My Night in a Las Vegas Conference Room

When Brad invited me to come to visit him in Vegas, I was excited about the trip.

Brad’s an old friend and we’ve spent a lot of time talking about markets, business, and life. So whenever I get a chance to spend a few hours with him, I jump at the opportunity.

After the market closed on Friday, I drove to Hartsfield Jackson Airport to jump on a plane. And that’s where the adventure started…

I’ll keep it short. But suffice it to say, the lines were long, flights were delayed, and both of my connecting flights were totally packed.

My flight didn’t land until well after midnight. And by the time I got to the hotel, they had already given away my room.

They literally put me in a fold-out bed in a conference room!

Frankly, I’m just thankful I had a place to sleep. More importantly, I’m impressed with how many people are traveling!

It’s a great sign for the travel and leisure industry.

So today, let’s check into some travel-related stocks to see where the opportunities are!

Travel Spending is UP!

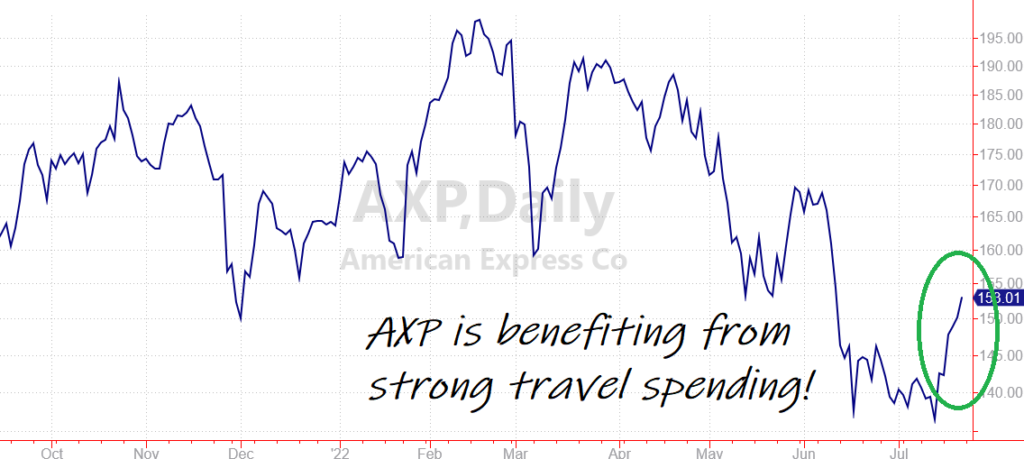

We’re in the middle of earnings season, and last week we got some important information from American Express (AXP).

While AXP is at heart a credit card company, the business is closely related to travel. Many customers use their Amex card simply because of the generous travel points they are rewarded with.

AXP’s earnings report beat expectations and the company raised its revenue guidance for the rest of the year. That’s great news!

The strong quarter was a direct result of record spending from card members. And that spending was driven by travel and entertainment purchases.

So my personal experience in a Las Vegas conference room wasn’t just an isolated event. Despite the market uncertainty, consumers are still spending money on travel… A lot of money!

Shares of AXP moved higher on the news.

Given AXP’s reliable (and growing) profits and dividend, AXP could have much further to run. Especially if travel spending continues!

Two Other Travel Names From My Watch List

Each weekend, I update my 20-20 Watch List to highlight the best plays that I’m finding in today’s market.

This weekend, I added some travel names to that watch list following AXP’s strong report and hat-tip to the travel industry.

Las Vegas Sands (LVS) has properties around the world. The company is well known for its “Sands Macao” which has roughly 1 million square feet of gaming and retail space.

While the stock has been weak due to concerns about China’s draconian coronavirus policies, shares traded above the 200-day moving average this week.

That’s the kind of breakout that could lead to much larger gains if investors come off the sidelines.

LVS is expected to earn $1.20 per share next year, and then double its profits in 2024.

Of course, political and economic uncertainty makes it difficult to know if those numbers will hold up. But for now, LVS looks like a good rebound play!

Another travel name to watch is Expedia Group Inc. (EXPE).

The company is expected to post profit growth of 325% this year. And profit growth will level out to “only” 36% in 2023.

Trading at just over 10 times next year’s expected profits, EXPE looks like a solid value pay in today’s market.

Of course, It can be very speculative to buy a stock like EXPE during a bear market. But now that the stock has already pulled back sharply, it’s definitely worth watching.

Speaking of watching (shameless plug, haha) — please be sure to check out my 20/20 Watch List. It’s a great resource to help you stay on top of the best opportunities in today’s changing market.

Here’s to growing and protecting your wealth!

Signoff…