Selling TRIP puts for income.

TripAdvisor Inc. (TRIP) is the worlds leading travel search company.

Despite higher interest rates and signs of a slowing economy, American consumers are still spending money on travel and entertainment. This bodes well for TRIP and should send shares higher.

The stock currently trades for less than 12 times next year’s expected profits, and shares are finding support after pulling back significantly.

Thanks to the stock’s volatility, option prices are very high. This helps us collect more income while taking less risk (because we can agree to buy shares significantly below today’s market price).

I expect strong travel trends through the end of the year which should drive strong profits for TRIP and its investors.

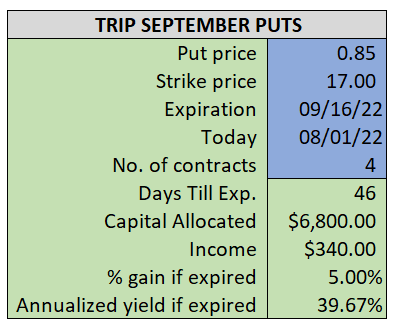

By selling the September $17 puts near $0.85, we’re able to collect an annualized yield near 40%, while also giving us roughly $2.00 per share in cushion between the current market price for TRIP and our strike price.

- Sell (to open) 4 TRIP September 16th $17 puts

- Limit: $0.85 or more

- The new position will represent roughly 7.8% of our model.

~~~~~~~~ - 15:32 Executed

- Sold 4 TRIP September 16th $17 Puts @ $0.88