Selling CPRI puts for income.

Capri Holdings (CPRI) is the high-end retailer behind brands like Michael Kors, Versace, and Jimmy Choo.

Inflation does not affect high-end consumers nearly as much as it challenges middle class families. So sales for luxury brands have remained relatively strong.

Recent data from American Express shows that affluent shoppers are spending money and CPRI will be a natural beneficiary.

Thanks to concern for retailers in general, the stock is cheap compared to company earnings. This helps to reduce the risk of CPRI trading much lower. Meanwhile, we’re getting an attractive amount of income from CPRI using our put selling approach.

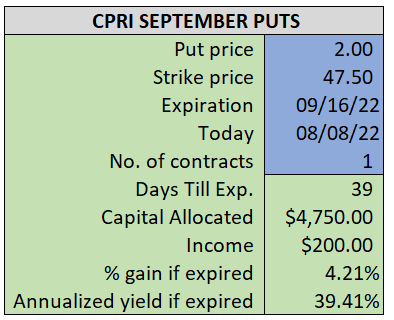

By selling the September $47.50 puts near $2.00, we’re able to collect an annualized yield near 39%, while also giving us roughly $3.50 per share in cushion between the current market price for CPRI and our strike price.

- Sell (to open) 1 CPRI September 16th $47.50 put

- Limit: $2.00 or more

- The new position will represent roughly 5.4% of our model.

~~~~~~~~ - 15:22 Executed

- Sold 1 CPRI September 16th $47.50 put @ $2.10