Greetings from Bretton Woods New Hampshire!

I’m on the road this week for meetings with my team. We’re at a historical landmark where the International Monetary Fund was established back in 1944. The meeting back then ushered in a new paradigm for financial markets which lasted for many years.

Today, the hotel is a vacation spot for many affluent families.

And like many other U.S consumers, these families are spending money on fun!

Many Consumers are In Great Shape

Despite what you hear on the mainstream media, many consumers are actually in great financial shape right now.

Advances in the stock market, inflation for real estate, and a strong employment picture has left many families with extra money to spend.

And after two years of lockdowns and travel restrictions, these families are making up for a lot of lost time!

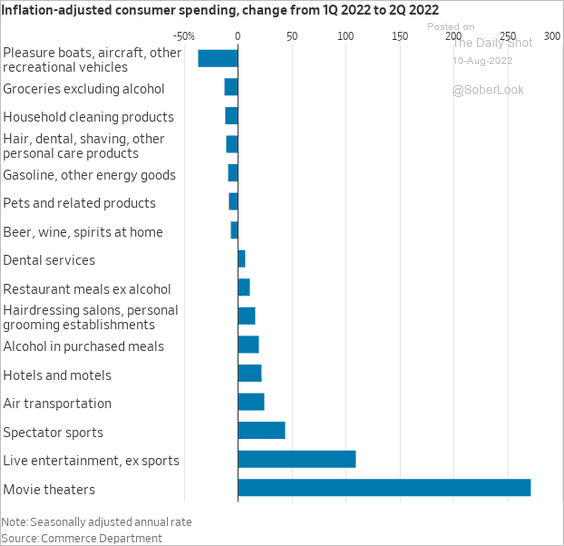

They’re spending on fun outings, nice dinners, and extra vacations. Just take a look at a recent data set from the Commerce Department:

Keep in mind, this morning’s inflation report was better than expected. On average, prices were flat in July compared to June. (They’re still 8.5% above last year’s level. But the month-to-month numbers look promising.)

If energy costs continue to ease, families will get more relief. And this gives consumers even more incentive to spend on fun.

You Can Profit From Spending on Fun

As consumers continue to spend on fun experiences, we can invest in a number of great rebound plays.

I’ve been talking a lot about travel stocks recently. And just this morning my Accelerated Income Model set up a new play on Norwegian Cruise Lines (NCLH)

[Shameless Plug: If you like the idea of collecting payments from some of your favorite stocks, you owe it to yourself to check out the Accelerated Income Model and see how it could work for your investments!]

Resorts, hotels, airlines, and theme parks are all areas that should benefit from spending on fun.

And while some of these stocks have already had nice runs so far this year, there’s still room for growth if inflation pulls back and consumers become more confident with their financial situation.

In fact, a pullback for inflation will give middle class families more discretionary spending – which in turn could lead to a new surge for travel, leisure and entertainment stocks.

I’ll be back to you later this week with some new investment ideas.

In the meantime, make sure you check out the Accelerated Income Model for new recommendations throughout the week!

Here’s to growing and protecting your wealth,

Zach