Selling KSS puts for income.

Kohl’s Corp. (KSS) is a U.S. retailer that has traded sharply lower this year. The company struggled with inventory issues and shifting consumer preferences.

At this point, the stock is attractively valued compared to expected earnings. And shares have been trading higher as investors start to put capital back to work in the market.

I expect KSS to improve on its dismal performance over the last couple of quarters. And now that much of the bad news is already out, It’s likely that KSS will beat lowered expectations, driving more investors into the stock.

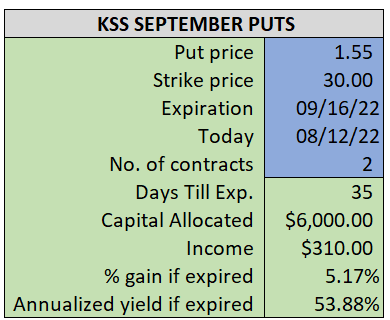

By selling the September $30 puts near $1.55, we’re able to collect an annualized yield near 54%, while also giving us roughly $3.10 per share in cushion between the current market price for KSS and our strike price.

- Sell (to open) 2 KSS September 16th $30 puts

- Limit: $1.55 or more

- The new position will represent roughly 6.7% of our model.

~~~~~~~~ - 15:19 Executed

- Sold 2 KSS September 16th $30 puts @ $1.60