Selling JWN puts for income.

Nordstrom Inc. (JWN) is a high-end fashion retailer with about 100 department stores in the U.S..

Affluent consumers continue to spend money, which is good news for higher-priced retailers.

JWN is expected to earn $3.12 this year and grow earnings slightly over the next two years.

With shares near $24.75, investors are paying just under 8 times expected profits. That’s an attractive valuation which should help support the current stock price.

JWN’s 3.1% dividend yield should also make the stock more attractive to income investors, helping to keep shares from any sort of meaningful pullback.

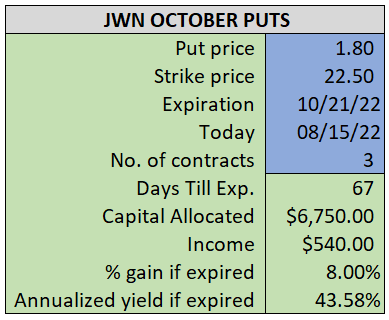

By selling the October $22.50 puts near $1.80, we’re able to collect an annualized yield near 44%, while also giving us roughly $2.25 per share in cushion between the current market price for JWN and our strike price.

- Sell (to open) 3 JWN October 21st $22.50 puts

- Limit: $1.80 or more

- The new position will represent roughly 7.6% of our model.

~~~~~~~~ - 15:06 Executed

- Sold 3 JWN October 21st $22.50 puts @ $1.83