Selling APA puts for income.

APA Corp. (APA) is an oil and gas producer with valuable crude and natural gas resources.

Shares are lower today thanks to a pullback in oil prices. But the overall trend for oil and natural gas is higher. There simply isn’t enough supply on the market. Meanwhile, OPEC+ producers are threatening to cut supplies to help keep prices high.

This is good news for APA and should help the company continue to generate lucrative profits.

We’ve successfully used APA for income plays in the past. One of the things I love about our strategy is that we can go back to the same stock — many times for some companies — and continue collecting more income payments.

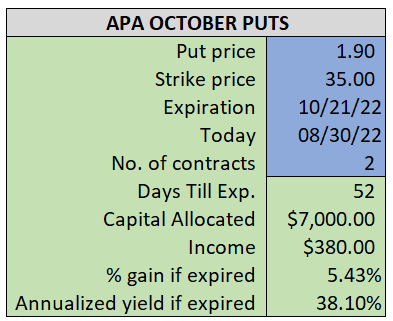

By selling the October $35 puts near $1.90, we’re able to collect an annualized yield near 38%, while also giving us roughly $4.20 per share in cushion between the current market price for APA and our strike price.

- Sell (to open) 2 APA October 21st $35 puts

- Limit: $1.90 or more

- The new position will represent roughly 8.1% of our model.

~~~~~~~ - 15:00 Executed

- Sold 2 APA October 21st $35 puts @ $1.199