Rolling our NCLH puts to an October expiration.

Shares of NCLH have been moving mostly sideways as investors become more comfortable with travel stocks.

I expect business to continue to pick up and for shares of NCLH to trade higher.

Our put contracts are scheduled to expire next week. And since NCLH is well above our $12.50 strike price, we can close these contacts out at a very cheap price.

From there, we can sell another set of put contracts to collect even more income from NCLH.

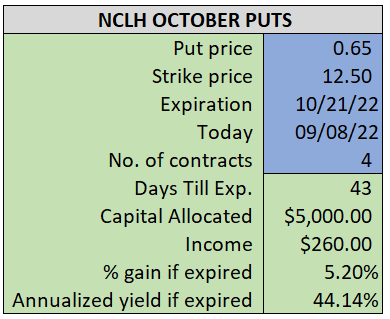

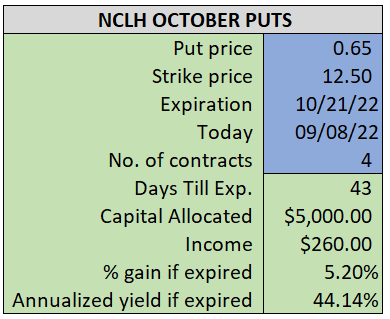

By selling the October $12.50 puts near $0.65, we’re able to collect an annualized yield near 44%, while also giving us roughly $1.60 per share in cushion between the current market price for NCLH and our strike price.

- Buy (to close) our NCLH September 16th $12.50 puts

- Limit: $0.13 or less

~~~~~~ - 13:09 Executed

- Bot 4 NCLH Sept 16th $12.50 Puts @ $0.11

ALSO

- Sell (to open) 4 NCLH October 21st $12.50 puts

- Limit: $0.65 or more

- The new position will represent roughly 5.7% of our model.

~~~~~~~ - 13:09 Executed

- Sold 4 NCLH Oct 21st $12.50 Puts @ $0.70