Selling OXY puts for income.

Occidental Petroleum (OXY) is a U.S. oil and natural gas producer.

There is a distinct imbalance between supply and demand for energy around the world. Global underinvestment in oil and natural gas production has led to surging prices.

This dynamic has been made worse by Russia’s invasion of Ukraine and the resulting embargoes on Russian energy products.

OXY is part of the solution to this problem, as the company produces roughly 1.2 million barrels of oil equivalent per day.

The company has also gained notoriety from a major investment by Warren Buffet’s Berkshire Hathaway. The investment company continues to accumulate shares of OXY, and this position should help to keep a floor under the stock price.

A recent short-term pullback gives us a great opportunity to set up a new income play for OXY.

By selling the October $14 puts near $0.80, we’re able to collect an annualized yield near 47%, while also giving us roughly $2.20 per share in cushion between the current market price for CHPT and our strike price.

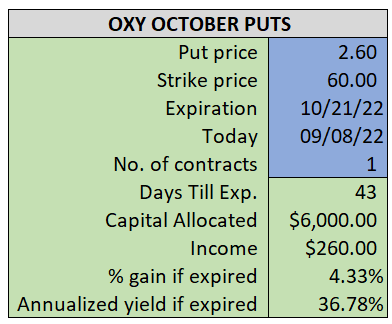

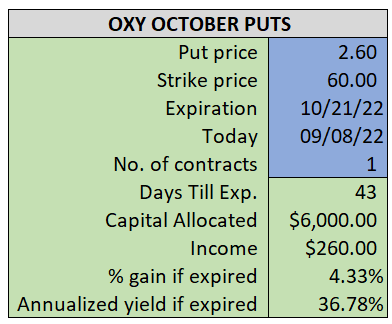

- Sell (to open) 1 OXY October 21st $60 put

- Limit: $2.60 or more

- The new position will represent roughly 6.9% of our model.

~~~~~~~ - 14:35 Executed

- Sold 1 OXY Oct 21st $60 Put @ $2.67