Rolling our RUN puts to a higher strike price and October expiration.

Solar energy stocks are gaining thanks to spending tied to the “Inflation Reduction Act.”

Shares of RUN are now well above our $30 strike price with just over a week until our contracts expire.

Today, we’ll go ahead and buy out of this position at a cheap price, and then sell NEW put contracts for October. This way, we can lock in profits and collect a new income payment from shares of RUN.

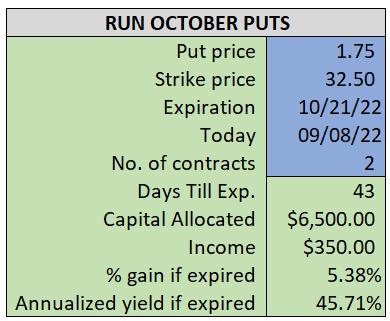

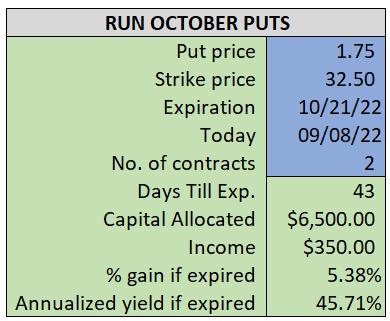

By selling the October $32.50 puts near $1.75, we’re able to collect an annualized yield near 46%, while also giving us roughly $5.60 per share in cushion between the current market price for RUN and our strike price.

- Buy (to close) our RUN September 16th $30 puts

- Limit: $0.20 or less

~~~~~~~~ - 11:15 Executed

- Bot RUN Sept 16th $30 Puts @ $0.16

ALSO

- Sell (to open) 2 RUN October 21st $32.50 puts

- Limit: $1.75 or more

- The new position will represent roughly 7.4% of our model.

~~~~~~~ - 11:15 Executed

- Sold 2 RUN Oct 21st $32.50 Puts @ $1.87