Take a look at the picture above. It’s a real world example of what happens when you over-correct while driving.

This was my daughters car last summer. Thank goodness she was ok (and learned a valuable lesson).

But it’s also a picture of what our economy could look like thanks to Fed Chairman Jerome Powell.

It’s the Fed’s job to keep the economy in the road…

Not too far on one side. (Don’t let inflation get too high and hurt savers.)

But not too far on the other side either. (Don’t let the economy get weak and hurt employment.)

I don’t envy Jerome Powell and of course his job isn’t easy.

But today’s interest rate decision made it clear that Powell and the Federal Reserve are over-correcting and driving this economy off the side of the road.

I just hope we walk away from the wreck with only minor bumps and bruises.

Powell’s Dangerous Direction

Today, the Federal Reserve raised its target interest rate by 0.75%.

The target rate is important for the overall market, because it influences the yield on treasury bonds (which many retirees hold), the rate for mortgages, and plenty of other interest rates throughout our economy.

By hiking interest rates (and promising more rate hikes to come), Jerome Powell is slamming the breaks on the economy.

To use the driver analogy, he’s also losing traction, skidding sideways and taking our economy in a dangerous direction.

Thanks to higher interest rates, families will have higher interest payments for homes, cars and consumer debt. (Yes, I know consumer debt isn’t wise. But it’s still part of the economy we live in.)

Businesses will also face challenges. It will be harder to borrow capital to expand — which will reduce hiring, increase layoffs, and also hurt profits. (That’s part of why the market is headed lower.)

Even the government is hurt by rising interest rates. Remember all of those entitlement and stimulus checks the U.S. has been handing out? Yeah, those are financed and require interest payments as well.

And get this…

The Fed’s tool of raising interest rates takes 6 to 9 months to actually work in the broad economy.

So even though we’re already seeing signs of weakness, the Fed is firing a bazooka-sized artillery round at our country — which will take effect in April when who knows how weak the overall economy will be.

(Sorry for the mixed metaphors.)

Bottom line, the Fed is over-correcting and by the time it becomes clear that interest rates are too high, the damage will already be done.

Protecting Your Wealth From Recession

If you’re worried about the Fed’s direction for our economy, the best advice I can give you is to invest in high-quality companies that can generate profits in good times and bad.

Think about the things you’ll buy regardless of how well your stock portfolio is doing. Chances are, the company you’re buying from is a stock worth investing in.

I especially like value stocks (stocks that trade for a low price compared to earnings), and dividend plays (that pay you while you wait for the economy to rebound).

If you want to get more aggressive, green energy stocks are some of the few bright spots in todays market. These companies will benefit from spending tied to the “Inflation Reduction Act” (which won’t do a thing to reduce inflation).

One other option is to use a trading approach that can profit from falling stocks (as well as stocks set to rebound).

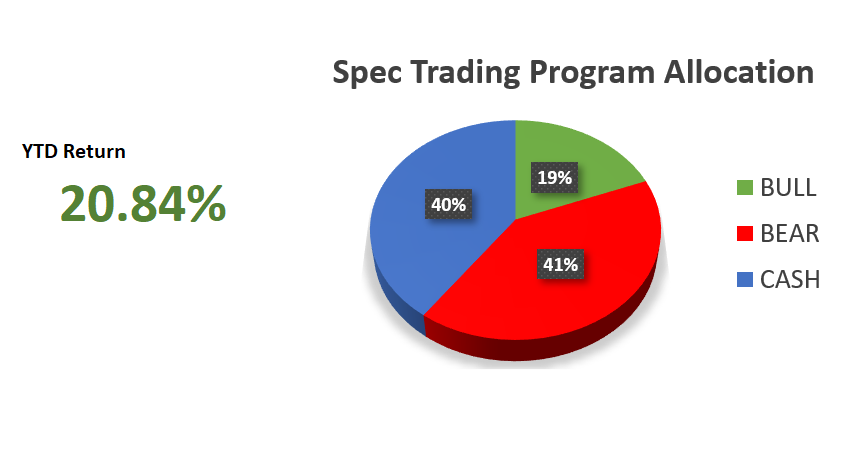

My Speculative Trading Program is an example. And while it has had plenty of winners AND losers, the overall program is currently profitable for the year.

You can see that as of Thursday’s close, the model has more bearish exposure. This means we’re expecting further weakness and set to profit if our bear plays trade lower.

This particular model is high-risk / potentially high reward. So I don’t advise putting more than a small portion of your overall wealth to work with a strategy like this.

But if you’re interested in an alternative approach to markets in this turbulent season, I invite you to give it a try!

(All subscriptions come with a 30-day money back guarantee. And if a monthly subscription makes more sense for your budget, just reach out to me and we’ll find a solution.)

Bottom line, we’re in for more challenges ahead.

Buckle up and make sure you’ve got a plan for protecting your savings!

Here’s to growing and protecting your wealth,

Zach