Selling KBH puts for income.

KB Home (KBH) builds homes in some of the most attractive U.S. real estate markets (including Arizona, California, Colorado and Nevada).

The stock has traded lower as investors worry that higher interest rates will cut off demand for new homes.

But with supplies of homes still very low and families still looking for homes to live in, the housing market should hold up better than many expect.

Shares of KBH are moving higher today as the broad market begins what could be a tradeable bear market rally.

KBH found support below $26, which is close to the same level the stock found support in June.

This gives me more confidence that there is a bit of a floor under shares of KBH, giving us a good opportunity to set up a new income play.

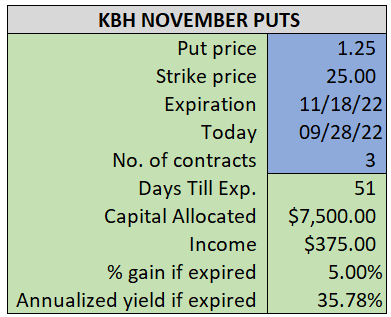

By selling the November $25 puts near $1.25, we’re able to collect an annualized yield near 36%, while also giving us roughly $1.60 per share in cushion between the current market price for KBH and our strike price.

- Sell (to open) 3 KBH November 18th $25 puts

- Limit: $1.25 or more

- The new position will represent roughly 8.7% of our model.

~~~~~~~~

- Executed 13:53

- SOLD 3 KBH Nov 18th $25 Puts @ $1.28